You’ve probably come across the word “phygital.” In marketing, it refers to blending the physical and digital worlds to create enhanced customer experience. In excise management, the principle is the same: combining the physical security of traditional tax stamps with the digital intelligence of traceability and authentication systems to better protect revenues, consumers, and markets.

As counterfeiters and tax evasion techniques become more sophisticated, tax stamps must evolve to stay one step ahead. The phygital approach is now emerging as a key strategy for governments to fight against illicit trade.

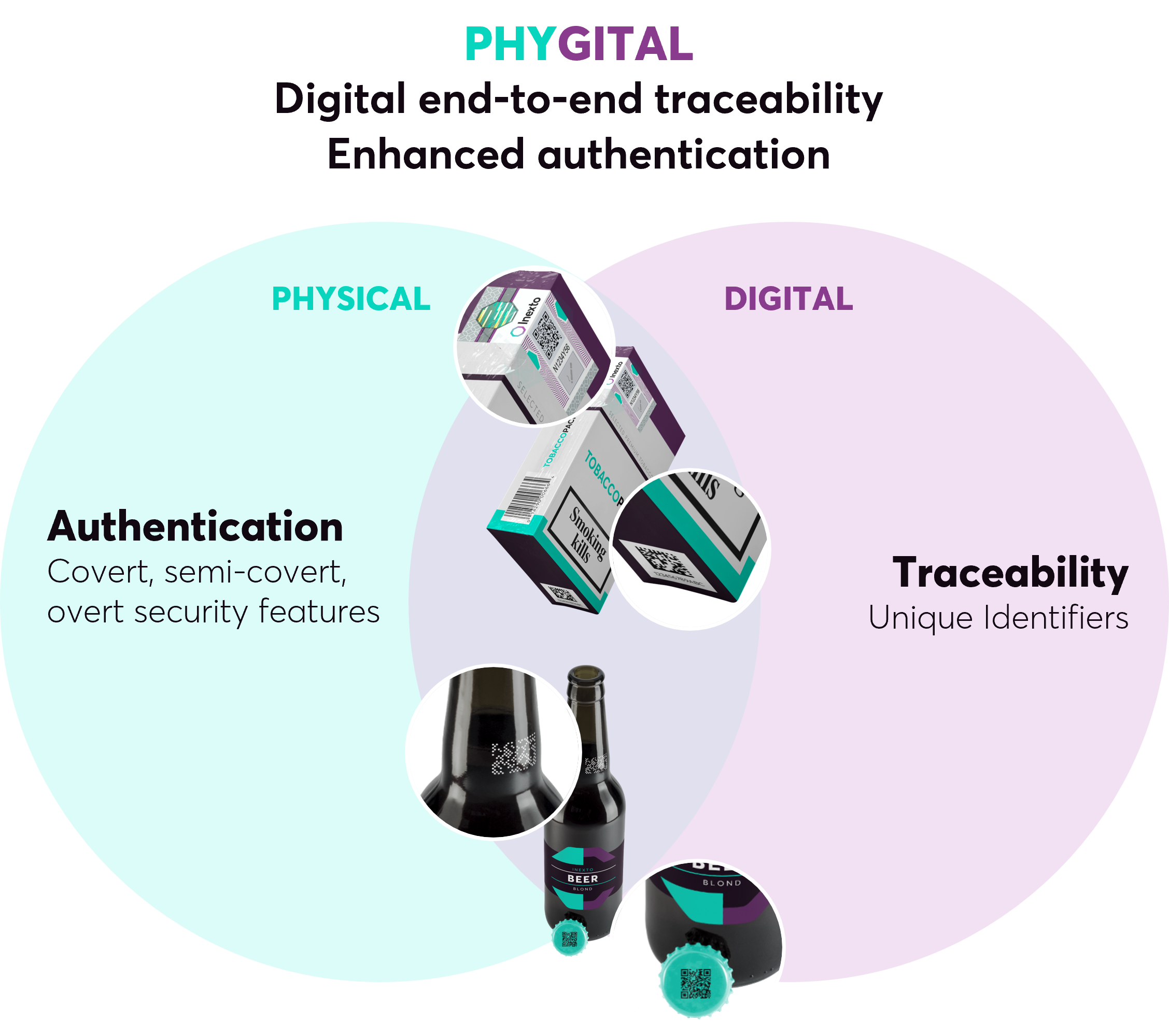

The synergy of physical and digital features

Traditional tax stamps have played a critical role in revenue protection for decades. Equipped with overt and covert security features – such as inks, holograms, and optical variable devices – they have been effective in fighting counterfeiting. But in today’s interconnected and fast-moving markets, physical measures alone are no longer sufficient.

Digital technologies now complement physical features by:

- Enhancing security through added layers of authentication

- Enabling track and trace and real-time production monitoring

- Making verification more robust and harder to bypass

Modern excise management requires:

- Real-time traceability across global supply chains.

- Enhanced authentication accessible at every stage, from manufacturer to consumers.

- Integration with legal frameworks to support new regulatory demands

This evolution mirrors the broader shift reflected in government-led initiatives such as the EU Digital Product Passport, the EU Tobacco Products Directive, and the WHO FCTC Protocol to Eliminate Illicit Trade in Tobacco Products – all emphasizing digital traceability.

At the same time, the private sector is also advancing. Brand owners and retailers are embedding QR codes and adopting the new GS1 2D barcode standards, extending product data access and consumer engagement well beyond traditional labeling.

Considerations

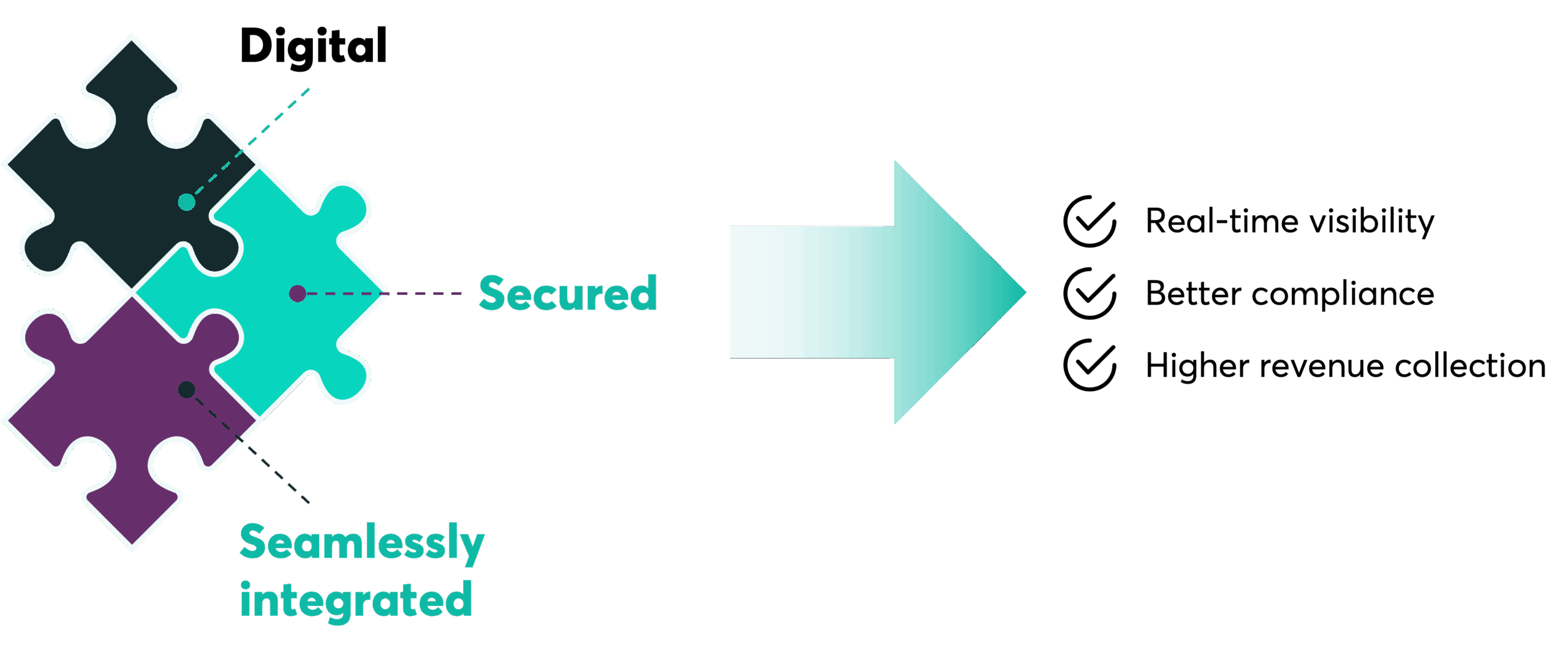

Integrating physical and digital elements into tax stamps is essential for combating counterfeiting and safeguarding tax systems. By harnessing the strengths of both approaches, governments and businesses can:

- Build a more resilient defence against fraud

- Enhance traceability and compliance across the supply chain

- Future-proof excise management systems against evolving threats

As technology continues to advance, the development and deployment of phygital solutions will be crucial in maintaining secure, efficient, and transparent excise tax administration worldwide.

Sources: The Strength of a ‘Phygital’ Approach – International Tax Stamp Association; Fortified Defences: The Power of Combining Physical and Digital Elements in Tax Stamps – International Tax Stamp Association

Tax stamps are evolving – so are Inexto’s solutions.

At Inexto, we help governments stay ahead of illicit trade with secure, scalable, and future-ready solutions. Talk to our experts today to learn how phygital solutions can protect your revenues and strengthen compliance.